Multifamily real estate

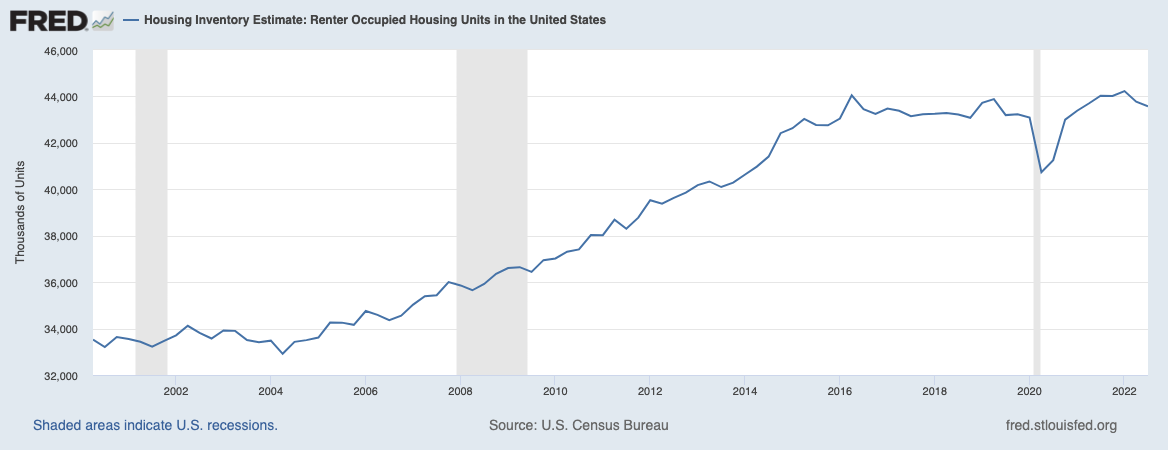

Investing in multifamily can be a reliable way to earn income and build equity. The growing population means more people will be looking for apartments, providing investors with a steady stream of rental income as well as potential for financial gain. Investing in multifamily provides both a secure asset and the chance of reward.

Let’s explore why investing in multifamily properties is a great way to earn passive income, can diversify your portfolio and provide long term wealth.